January 22, 2025

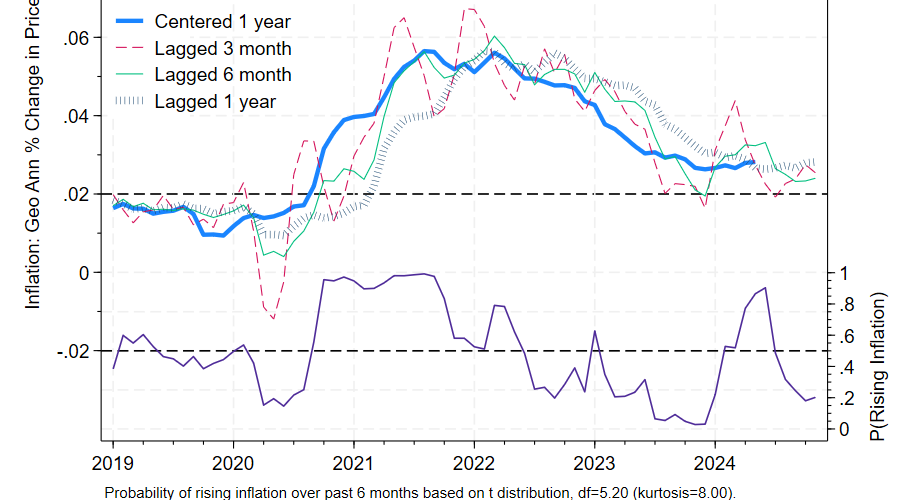

With the next PCE report coming on Jan 31, 2025, I thought I would review the report released last month. The above graph is a little different than the last post as it only uses the latest revised data and doesn’t bother to dig out inflation rates as they were originally reported. Comparison of the red, green, and inchworm lines, as well as the purple probability line, with the last post shows that the effects of the approximation are more than trivial.

One year core PCE inflation came in at 2.8%: inflation over the past year gives us an idea of general price pressures as of 6 months ago, halfway through the time span. The annualized six month lag provides the best estimate of centered inflation as of November 2024: that was 2.4%, a little lower.

Price pressures eased: given historical experience we’d expect November’s centered inflation to come in lower than centered inflation in May (6 months prior) about 80% of the time.

The Federal Reserve has a long term target of 2.0% inflation: the latest report indicates steady progress towards that goal as of November 2024.

ETA Jan 26, 2025: See the next post for a much better graph.